Chromatography Accessories & Consumables Market: Growth, Size, Share, and Trends

Chromatography Accessories & Consumables Market by Technology (GC, HPLC, UPLC, LPLC, Flash), Product (Columns (Prepacked, Empty), Detectors, Autosamplers, Vials, Septa, Degassers), End User (Pharma-Biopharma, Academia, F&B, O&G) - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

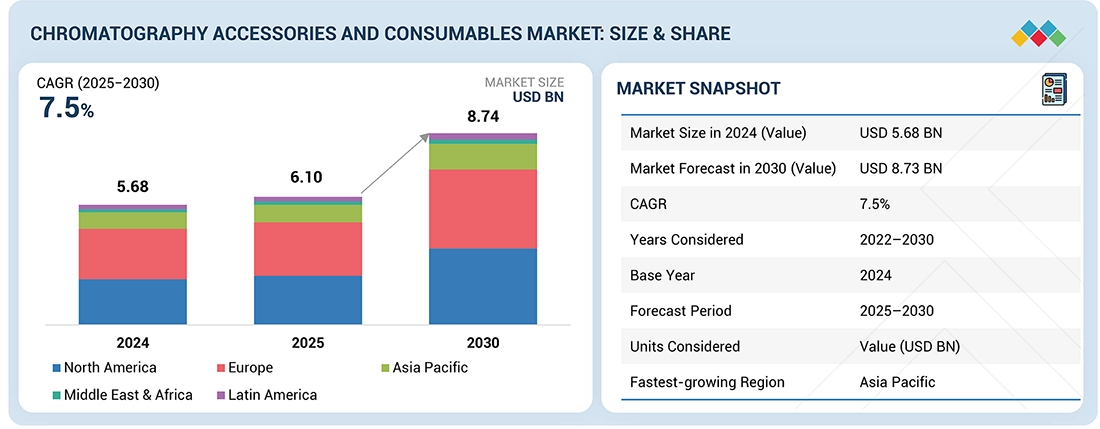

The chromatography accessories and consumables market is projected to reach 6.10 billion in 2025 to USD 8.7 billion by 2030, at a CAGR of 7.5% during this period. The global chromatography accessories and consumables market is witnessing robust expansion, driven by the accelerating adoption of chromatography across pharmaceuticals, biotechnology, food safety, environmental testing, and chemical industries. Chromatography remains the backbone of analytical separations, essential for purity analysis, drug discovery, metabolomics, proteomics, and clinical diagnostics. The market—encompassing columns, syringes, vials, fittings, tubing, guard columns, filters, and solvents—is increasingly being shaped by automation, miniaturization, and the push for high-throughput analysis. With a growing demand for precision separations and regulatory compliance in quality control processes, the market continues to evolve toward higher reproducibility and longer component lifecycles.

KEY TAKEAWAYS

-

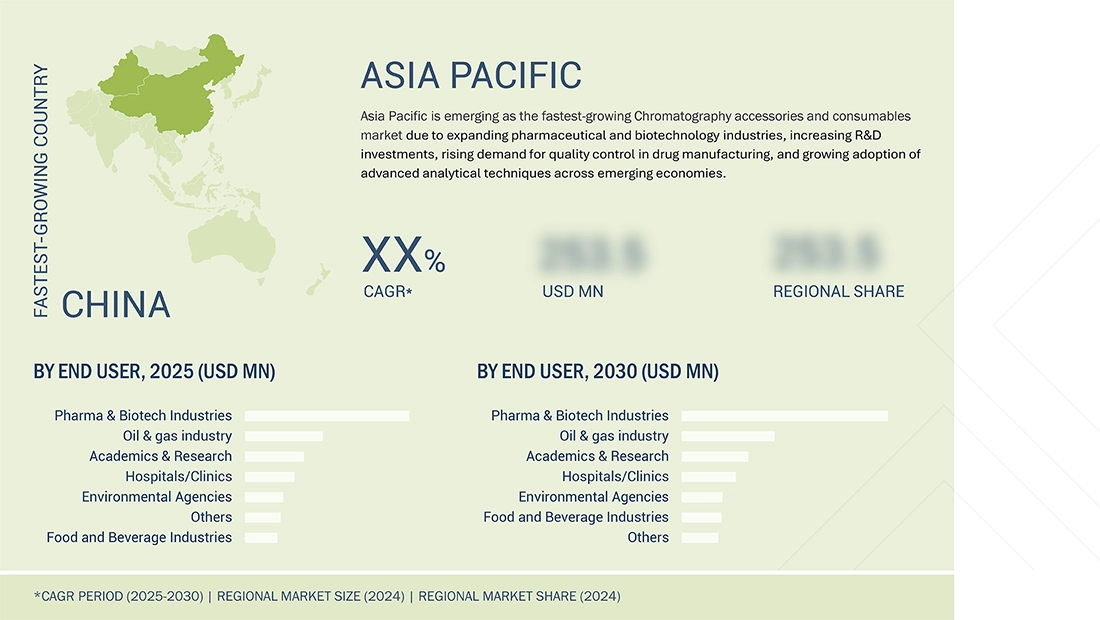

By RegionThe Asia Pacific market is estimated to grow at the highest CAGR during the forecast period. The high growth of this regional market can be attributed to the extensive sales of biosimilars in Japan; the high growth rate of the pharmaceutical & biotechnology industries in emerging markets; and the expansive focus on drug discovery & development owing to the increasing incidence of chronic diseases.

-

By ProductBy product type, The mobile phase accessories and consumables segment is expected to grow at the highest CAGR of 10.4% during the forecast period due to the growing adoption of high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC) techniques, increased demand for high-purity solvents and filtration products to ensure accurate analysis, and continuous innovation in solvent delivery and degassing systems that enhance chromatographic efficiency and reproducibility.

-

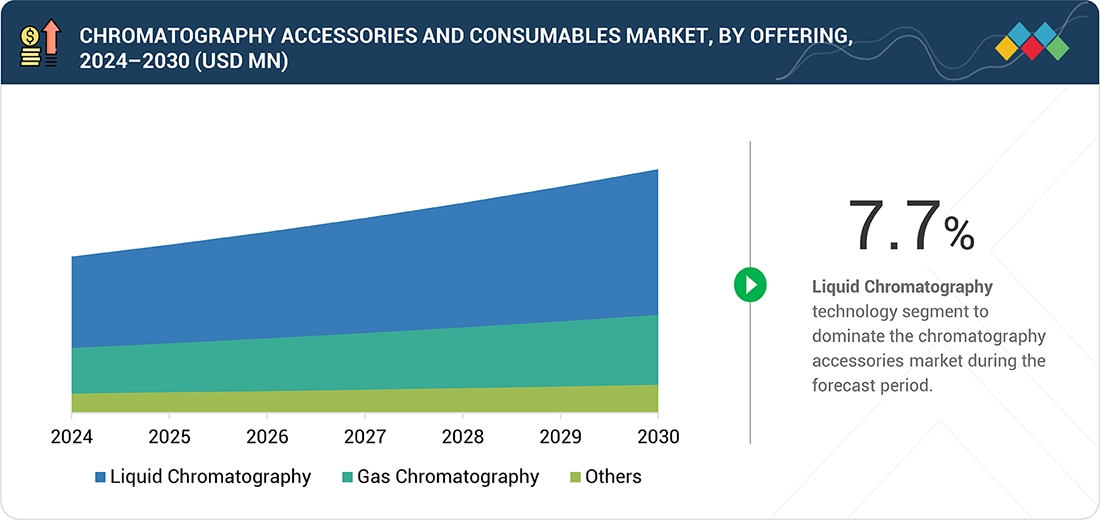

By TechnologyBy Technology, the liquid chromatography segment accounted for the largest share of 65.0% of the chromatography accessories & consumables market. The large share and the high growth rate of this segment is attributed to the broadening applications of LC, the growing focus on drug discovery & development, the increasing emphasis on R&D activities, and the high speed & accurate analysis offered by the technique

-

By End-userBy end-use application, The pharmaceutical & biotechnology Industries segment accounted for the largest share of the market in 2024. The large share of this segment is attributed to the increasing drug discovery & development activities that fuel the demand for chromatographic technologies in pharmaceutical & biotechnology companies

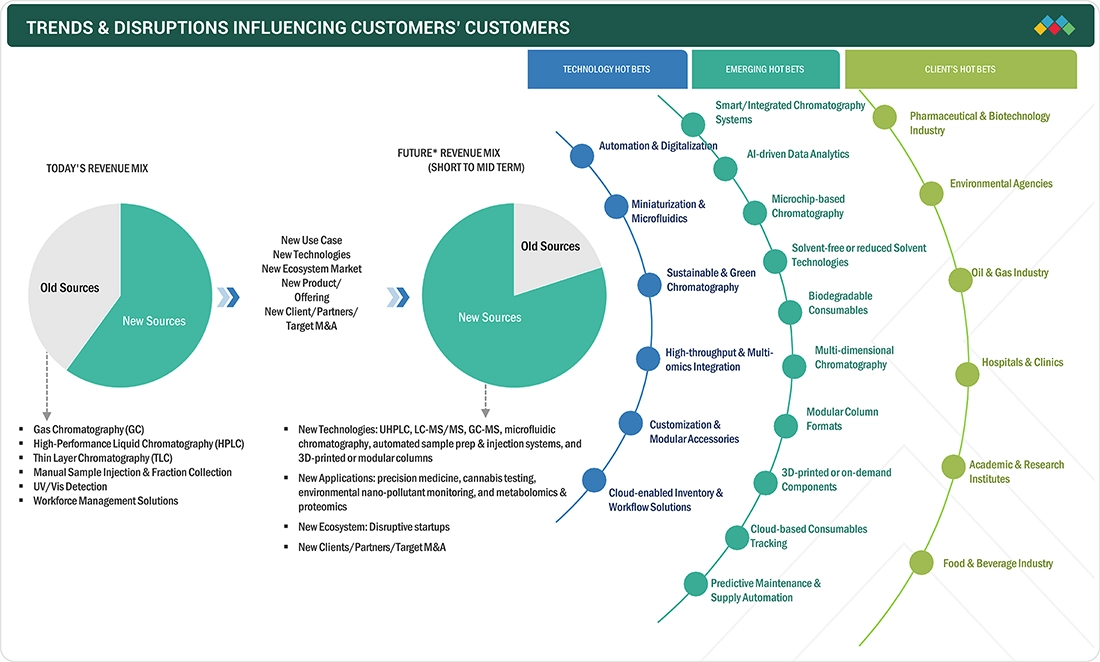

The market is transitioning from traditional manual chromatography to fully automated, modular, and software-integrated systems. End-users are increasingly emphasizing consumable standardization and compatibility across multi-vendor instruments. Vendors are focusing on eco-friendly solvents, low-bleed columns, and biocompatible fittings that support sustainable laboratory operations. Furthermore, single-use and pre-packed chromatography consumables are becoming mainstream in biopharmaceutical workflows, reducing contamination risk and operational downtime.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers’ workflows are being reshaped by digitization and the growing role of predictive analytics in chromatography system maintenance. AI-enabled chromatography data systems (CDS) are now helping users predict column lifetimes and optimize solvent use, while digital twins are emerging for process chromatography design. The rapid shift to single-use chromatography in biologics manufacturing and the integration of process analytical technology (PAT) are redefining purchasing priorities. Moreover, the global supply chain reconfiguration for critical consumables such as resins, frits, and tubing—especially after COVID-19—has led customers to seek regional suppliers and diversified sourcing strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investments in pharmaceutical R&D

-

Rising popularity of hyphenated chromatography techniques

Level

-

Premium product pricing

-

Shortage of skilled professionals

Level

-

Development of novel gas chromatography columns for petrochemical applications

-

Growing proteomics market

Level

-

Presence of alternative techniques

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising popularity of hyphenated chromatography techniques

Hyphenated methods usually combine chromatographic separation with peak identification by using conventional detectors such as UV with modern tools like MS (mass spectrometry), IR (infrared), or NMR (nuclear magnetic resonance) spectrometers. The advanced techniques provide numerous advantages such as faster analysis times, improved reproducibility, increased selectivity, greater automation, and reduced risk of contamination. These benefits have extended the application of hyphenated chromatography to a variety of scientific disciplines. Some of the most frequently employed hyphenated methods are LC-MS, GC-MS, LC-NMR, and LC-FTIR. Of all the new ones available, LC-MS and GC-MS have become notably prominent. LC-MS application for pharmaceutical analysis has increased dramatically over the last few years, and it is now an established instrument in the trade. It is used mainly for detecting and analyzing impurities in drugs. Its efficiency has found major applications in fields such as impurity profiling and total compound identification. Apart from pharmaceuticals, LC-MS finds widespread application in clinical diagnostics, pesticide residue screening, forensic analysis, and food analysis. Ongoing advancements in methods such as LC-MS and their definitive benefits are expected to fuel further market expansion in the coming years.

Restraint: Premium product pricing

Chromatography equipment normally has sophisticated features and functionalities, and therefore, they are very costly. Advances in technology have also increased the price because of enhanced developments in innovative systems. For example, the cost of an HPLC system normally ranges from USD 25,000 to 75,000. A single ready-to-use HPLC C18 column from a well-known producer may cost between USD 14,000 to 15,000. Conversely, the price of a GC instrument can range between USD 25,000 and 40,000, while GC consumables can cost between USD 1,000 and 2,500. Small- and medium-sized industries working in industries like oil & gas, food & beverage, and biotechnology & pharmaceuticals—along with educational and research centers—often need these systems. Nevertheless, the enormous capital investment required tends to restrict them from implementing the same. Academic research laboratories, in especially, encounter budget limitations that hinder the making of such a purchase. Beyond the initial cost of purchase, maintenance and indirect operating expenses add up to further increase the total cost of ownership. Therefore, adoption is restricted—particularly among cost-conscious users like research laboratories, academic institutions, and small businesses.

Opportunity: Growing proteomics market

Proteomics has emerged as an important field of biological study, ranging from biomedicine to plant biology. Ongoing developments in mass spectrometry and chromatography have considerably improved the speed and depth of proteomic analysis. For instance, the proteome of simple organisms can now be analyzed within a few hours. Nevertheless, complex organisms such as mammals can still be analyzed in a few hours or even days. Since conventional approaches usually fail to provide accurate and detailed information for complex mammalian proteomes, the market increasingly requires more sophisticated and effective chromatography instruments for this purpose. Chromatography has been the dominant method for protein separation in proteomics over the past few years, replacing 2D gel electrophoresis. The trend is anticipated to propel growth in the market for proteomics, which will consequently make a positive impact on the demand for chromatography consumables and accessories.

Challenges:Presence of alternative techniques

A number of methods—high-pressure refolding, charged ultrafiltration membranes, protein crystallization, capillary electrophoresis, two-phase and three-phase aqueous extraction, monoliths, membrane chromatography, precipitation, high-resolution ultrafiltration, crystallization—are identified as efficient alternatives to chromatography. These processes find special applications as alternatives to column chromatography in manufacturing protein therapeutics and monoclonal antibody separation. Column chromatography involves a minimum of two steps in the process of manufacture, which adds to higher production costs. Further, it involves several operations like equilibration, washing, elution, regeneration, and sanitization, thereby increasing the operational costs. In contrast, other methods involve fewer operations and can run large quantities of antibodies in one run. This decreases production costs and enhances the ability to produce more. Consequently, these benefits of alternative procedures can potentially restrict the growth of the chromatography consumables and accessories market.

chromatography accessories consumables market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilized LC–MS/MS and UHPLC systems for bioanalysis of small molecules and nanoparticles in preclinical and clinical research. Chromatography supports quantification of drug candidates in complex biological matrices. | Drives demand for high-performance LC columns, sample preparation kits, vials, and MS-grade solvents to ensure precision, sensitivity, and reproducibility in high-throughput studies. Regular method validation cycles result in steady consumables use. |

|

Deployed LC–MS-based bioanalysis to study protein–drug conjugates, tracking degradation and conjugation profiles during drug development. | Requires specialized stationary phases, guard columns, derivatization reagents, and calibration standards to accurately capture complex molecular interactions. The complexity of biologics testing increases reliance on high-grade consumables. |

|

Implemented GC–MS/MS and LC–MS/MS workflows for detection of multi-residue pesticides, contaminants, and mycotoxins in food products. | Large-scale testing drives recurring demand for SPE cartridges, GC liners, autosampler vials, solvents, and certified reference materials. The focus on global food safety compliance fuels continuous consumable replacement. |

|

Uses HPLC systems (Shimadzu Prominence, LC-2010) for formulation development, impurity profiling, and stability-indicating method validation. | Continuous QC and R&D work require high-purity solvents, analytical-grade columns, septa, and syringe filters. Regulatory testing and repeated validation protocols lead to ongoing consumable replenishment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The chromatography consumables ecosystem is composed of instrument manufacturers (Agilent, Thermo Fisher, Waters, Shimadzu, PerkinElmer), consumable and accessory suppliers (Phenomenex, GL Sciences, Hamilton, Restek, Sartorius, Tosoh Bioscience), and distributors serving diverse verticals. Partnerships between instrument vendors and consumable specialists are intensifying, resulting in bundled offerings that improve system compatibility and workflow efficiency. In addition, contract research organizations (CROs) and contract manufacturing organizations (CMOs) have become key influencers, as their growing reliance on high-throughput chromatography drives bulk consumable purchases.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Chromatography accessories and consumables Market, By Technology

Liquid chromatography (LC)—particularly high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC)—represents the largest segment, driven by its widespread use in drug formulation testing, impurity profiling, and metabolite identification. Gas chromatography (GC) consumables maintain significant share in environmental and petrochemical testing. In contrast, ion chromatography (IC) and supercritical fluid chromatography (SFC) are emerging niches driven by green chemistry and ion analysis in food and water testing.

Chromatography accessories and consumables Market, By Product

Columns and column accessories dominate the market, accounting for the largest revenue share. The reason lies in their critical role in separation efficiency and the frequent need for replacement due to performance degradation. Pre-packed and guard columns are witnessing strong uptake in biopharma applications for faster turnaround and reduced cross-contamination. Additionally, the demand for vials, caps, and filters continues to rise as sample volumes grow and analytical throughput increases.

Chromatography accessories and consumables Market, By End User

The pharmaceutical and biotechnology industries represent the largest end-user segment due to extensive chromatography use in research, quality assurance, and process monitoring. Rising adoption of process-scale chromatography in biomanufacturing and PAT-linked QC workflows continues to fuel demand. Academic institutes and CROs are secondary contributors, driven by expanding analytical research funding and outsourcing trends. Environmental testing labs and food analysis labs form a fast-growing segment propelled by stringent global safety standards.

REGION

North America accounted for largest share in global chromatography accessories and consumables market during forecast period

North America holds the largest share of the chromatography accessories and consumables market, supported by the strong presence of leading analytical instrument manufacturers, high R&D investments by pharma and biotech companies, and robust regulatory frameworks enforcing analytical quality. In contrast, Asia-Pacific is the fastest-growing region, propelled by rapid industrialization, expansion of generics manufacturing, rising food testing activities, and the establishment of biopharma research clusters in China, India, South Korea, and Singapore. Local production capabilities for consumables are improving, reducing import dependency and fostering domestic innovation.

chromatography accessories consumables market: COMPANY EVALUATION MATRIX

The market is moderately consolidated, with major players such as Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Shimadzu Corporation, Merck KGaA, and Sartorius AG leading through integrated instrument–consumable portfolios. Emerging players like Restek, Hamilton, GL Sciences, and Phenomenex compete via product innovation, custom chemistry offerings, and distributor-led market penetration. Leaders are emphasizing sustainability-linked consumable design, AI-driven supply chain visibility, and cloud-linked CDS integration to enhance user experience and brand differentiation. The future competitive landscape will be defined by co-development partnerships, value-based consumable pricing, and regional manufacturing scale-ups.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.68 Billion |

| Market Forecast in 2030 (Value) | USD 8.73 Billion |

| Growth Rate | CAGR of 7.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

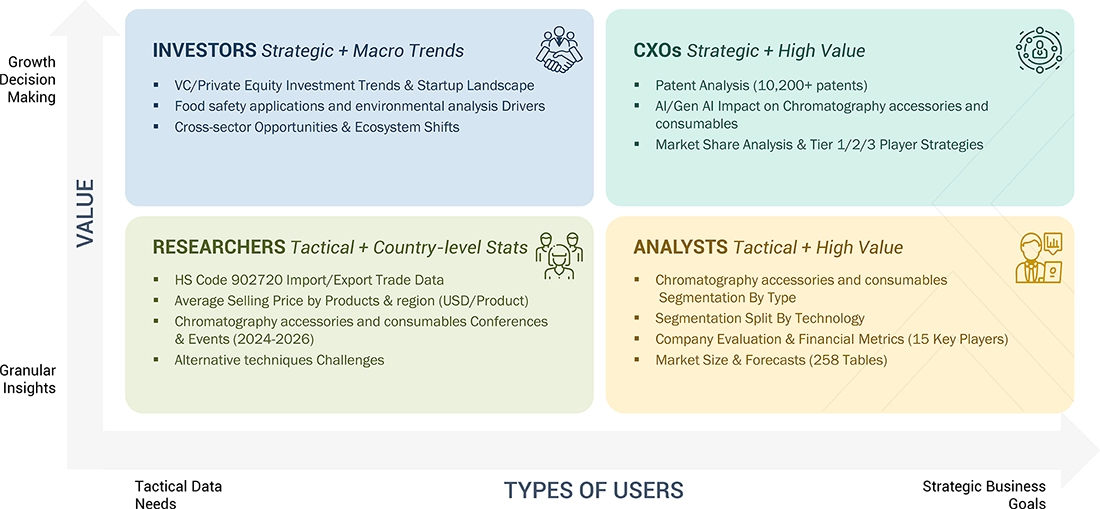

WHAT IS IN IT FOR YOU: chromatography accessories consumables market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Life Sciences Instrument Manufacturer | Competitive profiling of chromatography accessory and consumable suppliers (product range, pricing, distribution) | Benchmarking of consumable usage across leading chromatography systems |

| Composite Material Manufacturer |

|

Cost-performance evaluation of filters, columns, and vials |

| Contract Research Organization (CRO) | Performance benchmarking of consumables under high-throughput workflows | Supplier evaluation for turnaround time, quality consistency, and technical support |

| Academic & Research Institute | Mapping of consumable suppliers by regional presence and research-grade quality | Lifecycle cost analysis for chromatography columns and consumables |

| Biotech Start-Up | Comparative assessment of consumables suited for small-scale and pilot-scale workflows | Vendor evaluation for customization potential and scalability |

RECENT DEVELOPMENTS

- April 2025 : Shimadzu entered into a merger with these companies and has decided to change its name to Shimadzu Chemistry and Diagnostics SAS. This development aims to expand the firm’s business operations by introducing a new lineup of reagents and consumables.

- February 2025 : Thermofischer acquired Solventum's purification & filtration business, strengthening Thermo Fisher’s bioprocessing offerings and expanding its business operations.

- September 2024 : Agilent acquired the Canada-based contract development and manufacturing organization (CDMO), specializing in biologics, highly potent active pharmaceutical ingredients, and targeted therapeutics.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

This study relied heavily on both primary and secondary sources. Extensive secondary research was conducted to gather information about the chromatography accessories & consumables industry. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Various approaches were employed to estimate the overall market size, including top-down and bottom-up methods. Subsequently, market segmentation and data triangulation procedures were applied to determine the market size of different segments and subsegments within the chromatography accessories and consumables market. The research also examined various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, essential market dynamics, and strategies employed by key market participants.

Secondary Research

The secondary research process relies heavily on secondary sources, including directories, databases such as Bloomberg Business, Factiva, and D&B Hoovers, white papers, annual reports, company documents, investor presentations, and SEC filings. This type of research was utilized to gather valuable information for a comprehensive, technical, market-oriented, and commercial analysis of the chromatography accessories and consumables market. It also helped me acquire crucial insights into key players and the market's classification and segmentation based on industry trends down to the most detailed level. Additionally, significant developments related to market and technology perspectives were identified. A database of the key industry leaders was created using this secondary research.

The market for companies offering chromatography accessories & consumables services is assessed through secondary data from paid and unpaid sources. This analysis involves examining major companies' product portfolios and evaluating their performance and quality. Various sources were consulted during the secondary research process to gather comprehensive information for this study. The secondary research provided essential insights into the industry's value chain, identified the key players, and facilitated market classification and segmentation from market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to gather qualitative and quantitative information for this report. The supply-side primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations in the chromatography accessories and consumables market. On the demand side, primary sources included OEMs, private and contract testing organizations, and service providers. This primary research validated market segmentation, identified key players and gathered insights on significant industry trends and market dynamics.

After completing the market engineering process, which included calculations for market statistics, market breakdown, estimation, forecasting, and data triangulation, we conducted extensive primary research. This research aimed to gather information and verify the critical numbers obtained through initial calculations. Additionally, we identified various segmentation types, industry trends, and the competitive landscape of chromatography accessories and consumables devices offered by different market players. We also examined key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and the strategies of major players in the market.

In the comprehensive market engineering process, top-down and bottom-up approaches and various data regulation methods were utilized to estimate and forecast the overall market segments and subsegments outlined in this report. Extensive qualitative and quantitative analyses were conducted throughout the market engineering process to highlight key information and insights presented in the report.

A breakdown of the primary respondents is provided below:

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the chromatography accessories & consumables market size. These methods were also used extensively to estimate the size of various segments in the market.

Revenue share analysis was employed to determine the size of the global chromatography accessories and consumables market about the leading players to determine the size of the global chromatography accessories and consumables market. In this case, key players in the market have been identified, and their chromatography accessories and consumables business revenues were determined through various insights gathered during the primary and secondary research phases. Secondary research included studying top market players' annual and financial reports. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, particularly chief executive officers, directors, and key marketing executives.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global chromatography accessories and consumables market was split into segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches validated the chromatography accessories and consumables market.

Market Definition

Chromatography is used in analytical chemistry to separate and analyze volatile compounds without decomposition. It conducts complicated separations like amino acid sequencing or pollutant separation. In this non-destructive technique, separation is based on differential partitioning between the mobile and stationary phases. Chromatography accessories and consumables play a vital role in the operation of chromatography systems. These products are usually required to operate and maintain chromatography instruments and systems.

Stakeholders

- Chromatography instrument manufacturers

- Chromatography consumable manufacturers

- Third-party chromatography instrument suppliers

- Raw material suppliers for instruments

- Oil & gas companies

- Environmental protection agencies & institutes

- Food & beverage companies

- Pharmaceutical & biotechnology companies

- Cosmetics companies

- Market research & consulting firms

- Regulatory bodies

- Venture capitalists

Report Objectives

- To define, describe, and forecast the chromatography accessories and consumables market based on technology, product, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global chromatography accessories and consumables market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global chromatography accessories and consumables market

- To analyze key growth opportunities in the global chromatography accessories and consumables market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain and Rest of Europe), Asia Pacific (Japan, China, India, Australia, Thailand, Singapore, Indonesia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of Middle East & Africa)

- To profile the key players in the global chromatography accessories & consumables market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global chromatography accessories & consumables market, such as agreements, expansions, and product launches

Key Questions Addressed by the Report

What is the projected value of the global chromatography accessories & consumables market during the forecast period?

The market is projected to grow from USD 6.10 billion in 2025 to USD 8.74 billion by 2030, at a CAGR of 7.5%.

By product, which segment accounted for the largest market share in 2024?

The columns segment accounted for the largest share in 2024, driven by FDA regulatory guidelines and increasing R&D investments.

What strategies are adopted by the leading players in the market?

Leading players use product launches, collaborations, partnerships, agreements, and expansions to strengthen their market presence.

What are the primary factors expected to drive the growth of the chromatography accessories & consumables market?

The growing popularity of hyphenated chromatography techniques and the rising use of chromatography in food safety applications are key growth drivers.

What are the specific challenges companies face in the chromatography accessories & consumables market?

The market faces challenges from alternative techniques such as precipitation, high-resolution ultrafiltration, and crystallization.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Chromatography Accessories & Consumables Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Chromatography Accessories & Consumables Market